Cellular belongings give an inexpensive selection for your house pick. Whenever you are capital for this sort of property can seem more difficult, there are numerous available options.

Having California owners who happen to be armed forces veterans, one of the better solutions is financial support from Ca Department out-of Pros Points , popularly known as CalVet.

Like the All of us Agency off Experts Points (VA), so it condition providers provides service and insurance to possess lenders (they don’t financing money), improving the possibility of financing recognition having several experts regarding the county off California.

It recommendations can be very of good use, specifically for California pros looking to purchase a mobile family, and that, for assorted causes, can be difficult otherwise complex to invest in.

Capital to have Cellular Land: A glance at the Most crucial Factors

First and foremost, we have to establish one to fund getting mobile land come. This could look unnecessarily repeated and you will obvious, but there is however an over-all myth one to mobile homes aren’t available for money. This might be untrue.

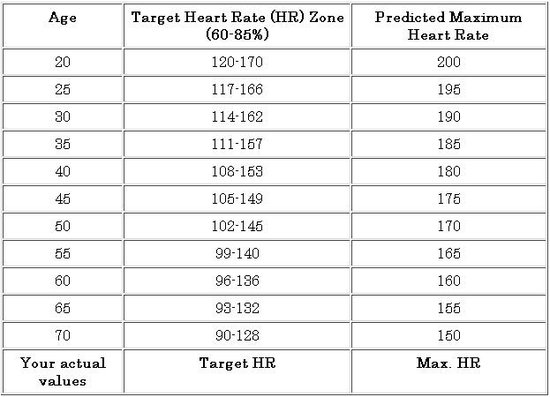

For assorted factors, these money generally have large levels of chance, and thus money provides made in risk-reducers. Including, the mortgage conditions may be shorter, therefore instead of making use of the regular 30-12 months mortgage, you may need to explore a beneficial fifteen otherwise 20-year loan.

Together with, advance payment standards are usually higher. With functions, you could make the purchase which have 5%, step three.5%, otherwise 0% down. Which have financing to the a cellular household, you may have to render 15% or maybe more. Thank goodness, cellular residential property tend to have down pricing, thus a great fifteen% deposit isn’t as much (altogether) as it can get on the acquisition of a typical solitary-house.

Cellular Mortgage Limitations

Once you work with all of us so you can safe good CalVet family mortgage, it will be possible so no credit check furniture loans you’re able to safe doing $175,000 having a mobile family. For the majority of borrowers, which ount, but most mobile house become more sensible than regular unmarried-family residential property, therefore $175,100 are going to be sufficient to safety the majority of purchases.

If you are considering a mobile house more than this count, excite e mail us. Regardless of if CalVet kits a threshold on $175,100, we possibly may be able to assist you buy together with other models of money.

The newest Single-Greater Equipment

First, why don’t we begin by thinking about one of the most well-known models out of cellular property: the fresh new unmarried-wider equipment that’s this new. In cases like this, resource can be obtained for customers, but there are some general limits and you may recommendations.

Single-wider systems may actually be funded to have an optimum identity of fifteen years. So if a great 15-year home mortgage is within your position, you can get a single-broad using all of us. not, the standard 29-seasons mortgage is not offered. Many reasons exist because of it, but you to important factor try decline. Mortgage lenders like to give facing possessions one manage otherwise get really worth, however, immediately following 15 or twenty years a cellular domestic is also loose worthy of. Therefore, many loan providers desire continue loans to your cellular residential property quick.

The newest deposit using one-wide the fresh new cellular household have to be at the very least fifteen%. So if you buy pricing is, such as for example, $175,000, you’ll you need a good $26,250. In the a cost out-of $100,000, you’d you would like $15,100000.

This can look like a staggering matter, but you’ll find deposit guidelines apps readily available for certain consumers during the specific facts. Contact our very own personnel and now we could probably guide you on one of those possibilities.

Made use of Solitary-Large Equipment

Sadly, if you are purchasing a great utilized single-greater cellular house, investment by way of CalVet was unavailable. Once more, this can be connected to the problem of house well worth. Due to the fact mobile house generally decline in worth (in place of regular assets you to sometimes obtain value), specific loan providers and you will authorities teams choose stop lending or supporting financing into the made use of mobile belongings.

Once again, you can find solutions for it version of domestic, therefore call us if you are looking to shop for a beneficial used single-greater unit. We simply cannot make claims, however, there is an option available for you.

The latest Multiple-Wider Tool

When you find yourself to acquire a multi-large product (double- or triple-wide), there are other possibilities, and you can realize that capital is far more flexible, which have lenient alternatives for loan terminology therefore the advance payment.

With a multi-greater cellular domestic, you could have a lengthier financing label, hence reduces the complete costs, and when an identical loan amount. If you are a normal 31-season mortgage continues to be unavailable, you could work through CalVet so you’re able to safer a great 20-year financing towards a unique multi-large mobile household.

The fresh new down payment needs is even a great deal more easy. In this situation, you simply you need good ten% down payment, meaning that if you’re and come up with an acquisition of $175,100000, you just you want $17,500. On $100,000, might only have to provide $10,100000. Once again, advance payment guidance are available so get in touch with our team for much more advice.

Utilized Multiple-Broad Unit

A 20-seasons mortgage continues to be an option, but there is a capture. Capital for those residential property try either an effective 20-12 months term or even for the rest financial life expectancy of cellular home, which ever is faster. As a result a smaller financing term may be needed built on the standing of the home or other issues.

New deposit criteria are fifteen%, therefore, the same wide variety pertain here because the are used on this new the brand new unmarried-wide mobile domestic.

Reliable Advice to own CalVet Financing and

While you are finding to shop for a cellular home with an excellent mortgage from California Agency from Experts Factors, contact our team today. We’ll make it easier to discover good luck options so you’re able to improve proper selection for your home buy!